With a global market estimated to hit $90 billion by the end of the decade, it’s no wonder everyone’s talking about cultured meat. The goal was to be first to market, a feat accomplished by Eat Just when its cell-cultured chicken was served at a restaurant in Singapore in 2020, while many other companies have produced cell-based ground beef, poultry, and seafood.

Additionally, in late 2022, the FDA evaluated the safety of cell-cultivated meat and concluded that it is safe for human consumption, a major milestone for alternative protein producers whose cutting-edge technologies promise a sustainable and plentiful food source for a growing world. Because of this approval, it’s no shock that our 2023 Horizons: Alternative Proteins survey results showed that about 75% of cultivated meat companies plan to launch product in the next 2 years. Now that the first heat of the race has been settled, the big question is what version 2.0 of cultured meat production will look like.

The most urgent concern for the industry is how to achieve sufficient scale to meet burgeoning consumer demand, making cost one of the biggest barriers to widespread consumer uptake. Emerging cell-based manufacturers may have challenges with cost and profit targets, given that their facilities are targeted to produce a yearly output averaging around 300,000 pounds per year in 2027. While this number is remarkable for such a new industry, the data around the long-term profitability is still far too little to compete with traditional meat.

The Good Food Institute (GFI), a nonprofit advocacy group for the alternative protein industry, published research outlining what needs to happen to bring down the price of alternative meat. GFI believes the price can be lowered to a much more palatable $2.57 per pound by the end of the decade. Others argue it may be impossible to achieve parity with the price of animal meat given the high cost of clean rooms, equipment, and media, as well as low cell culture productivity. Even with divergent predictions, there is one thing everyone seems to agree on: There are significant technical challenges manufacturers must overcome if cultured meat is going to deliver on its promise.

At the top of the list is how to scale today’s production to the point where, not only is it commercially viable, but it offers a viable alternative to the animal meat market. Scaling up cultured meat production to achieve commercial viability will require addressing three major challenges:

- Significantly reducing the costs of culture media, equipment, and clean rooms

- Increasing productivity and throughput of both growing cell cultures and final product by improving upstream and downstream processes

- Addressing product differentiation to meet expanding consumer expectations

What is cultured meat?

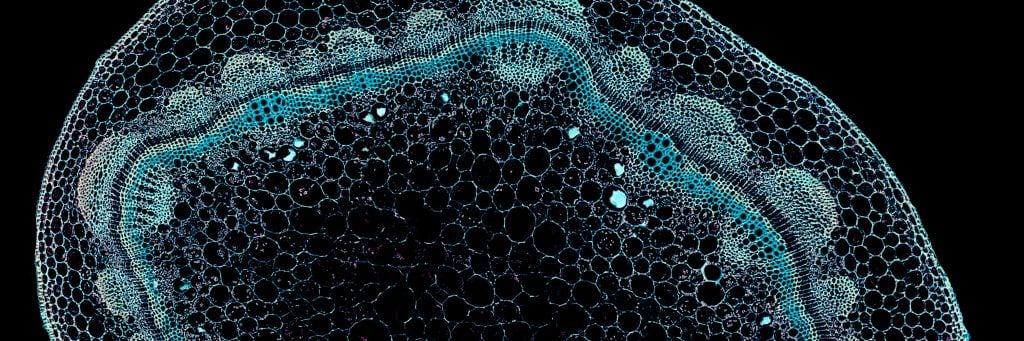

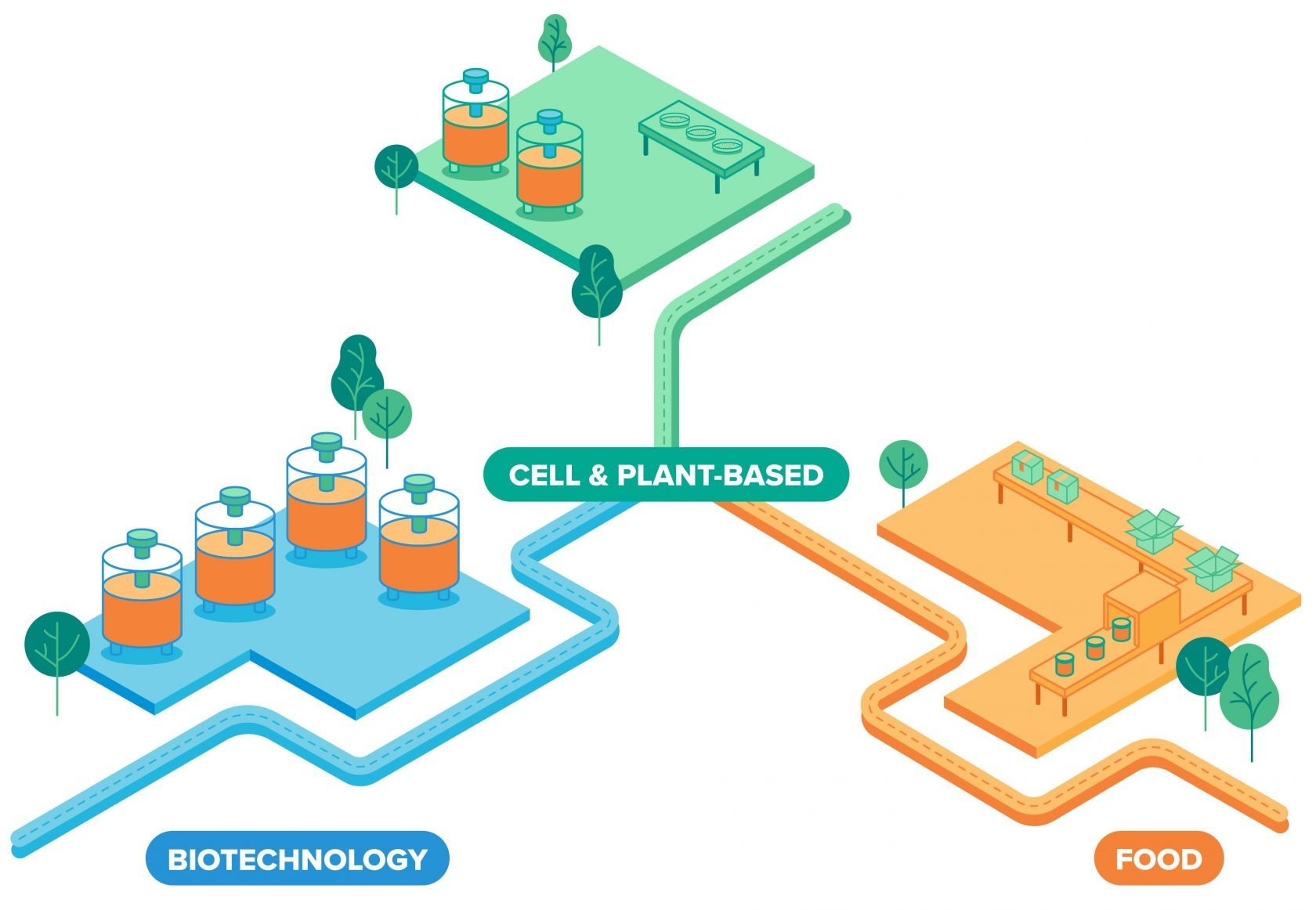

Cultured meat—also known as cultivated meat, cell-cultured meat, and cell-based meat—is produced by growing animal cells and processing them into a variety of meat products. Along with plant-based proteins, including meat, seafood, eggs, and dairy, this form of cellular agriculture has the potential to alleviate some of the environmental and ethical concerns of animal meat production while improving food security for an ever-growing world population.

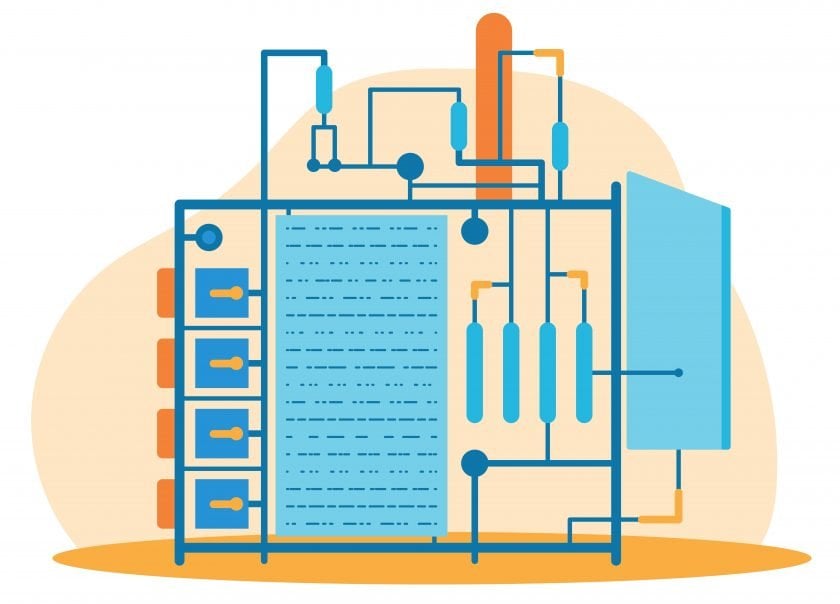

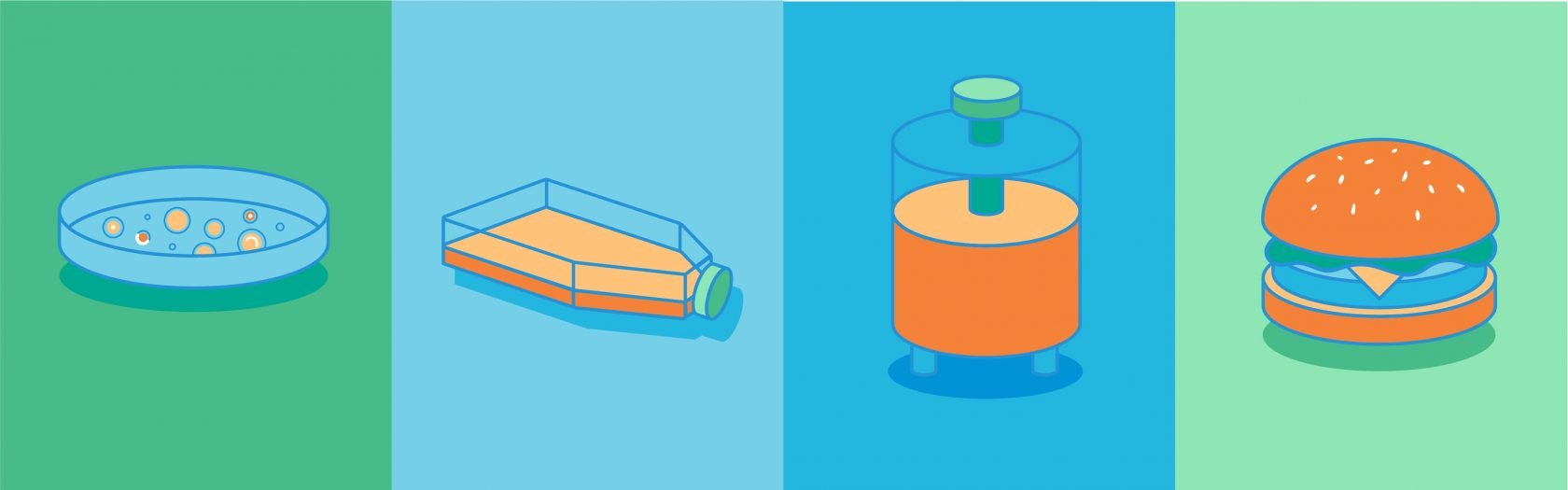

The process to make cultured meat begins when cells are grown in culture media, first in flasks, then in bioreactors of increasing volumes. The slurry of cells is harvested, formed, and processed to create meat, such as ground beef, chicken nuggets, or seafood products. The two types of bioreactors—stirred tank and perfusion—are similar to those used in the biotech industry. While perfusion bioreactors allow continuous processing, they are smaller and more difficult to scale up.

Cultured meat production takes inspiration from biopharma

When considering how to scale up, startups have taken their cue from biopharmaceutical manufacturing, which has been growing cell cultures at large scales for decades. Much of the upstream processing of cultured meat relies on similar equipment and techniques used to make viral vaccines, monoclonal antibodies, and other biologics. As a result, companies can scale up, test proof of concept of new processes, experiment with product differentiation, and get to market as fast as possible.

Making tons of cultured meat, however, is different from making millions of doses of a viral vaccine. For one thing, while the final product is a food commodity with a much lower selling price, some companies adopt the same approach used to make expensive medications: pharmaceutical-grade raw materials, complex 20,000-liter stainless steel bioreactors, and the stringent facilities to hold them.

But the industry is still determining how to adapt technologies from biopharma and scale them for products with much lower cost per pound. This may involve sourcing food-grade media components from lower-cost suppliers, rightsizing a facility, and modifying existing technologies to be cost effective among other decisions.

To scale up cultured meat production, costs must come down—drastically

To achieve commercialization of cultured meat at scale, producers need to find solutions to lower the cost of media, equipment, and clean rooms.

Media is by far the most expensive component of production

Traditional growth media is a mixture of nutrients, including amino acids, recombinant proteins (e.g., albumin, insulin, and transferrin), micronutrients such as growth factors, and, in some cases, fetal bovine serum. Some of these inputs are prohibitively expensive; TGF-𝛃 can cost more than $3 million per gram. The industry needs to find, or develop, food-grade sources of the ingredients to drive down costs. In fact, our Horizons: Alternative Proteins report, shows that 37% of companies are targeting media at less than $1/L and 59% are targeting between $1/L-$4.99/L.

As of 2020, culture media accounts for 55–95% of the cost of goods, according to GFI, so driving down media costs provides the greatest benefit for industrial-scale cultivated meat production.

Companies are finding novel ways to bring media costs down, using new technologies and non-traditional sources. Here are three options to reduce the cost of media:

Reuse media

Cultured cells are considered waste in the production of viruses or monoclonals; alternatively, these are actually the products for cultured meat—as long as manufacturers address or remove the buildup of catabolites. It’s a significant step as catabolites eventually inhibit cell growth. Done properly, producers could reuse the most expensive input in the entire process.

Continuous harvesting and perfusion bioreactors

Perfusion reactors hold great promise for significantly increasing cell mass production and reducing the volume of growth media needed. They do so by removing waste material and, in some cases, recycling media for reuse. They are also smaller than traditional fed-batch bioreactors and, thus, use less media.

Use non-traditional raw materials

Finding alternatives to the most expensive ingredients will go a long way to bringing down costs. Materials developed specifically for food production, such as serum-free media and amino acids derived from soy, hold potential.

To scale up, innovate and adapt equipment

We expect to see continued innovations in equipment that maximizes meat production while minimizing costs. Leveraging the expertise and equipment from biotech and animal meat processing can help de-risk technologies, especially when choosing equipment and processes that can be scaled.

- Simplify processing equipment

Bioreactors, and other upstream equipment, from biopharmaceutical manufacturing have attributes that are unnecessary for food production, adding significant cost to the equipment and hampering commercial viability. [see sidebar] - Test equipment and lean out the process before scaling up

An example is single-use bioreactors, which can be used for the seed stage of cell culturing if it makes sense from a cost perspective. - Run consecutive batches without cleaning or sterilization

This improves overall equipment effectiveness (OEE) and throughput, while reducing utility demand. - Consider single use for seed bioreactors

This could reduce costs at a certain scale and could be confirmed by running studies.

Clean rooms are expensive – implement closed processing instead

Clean room use by cultured meat producers is not well-grounded on a technical basis, thus we have the option to leave them out to reduce the cost of a facility. It can be ten times more expensive—roughly $1,500 per square foot—to construct a clean room as opposed to an unclassified room. Additionally, the open processing used in Class ISO 8 clean rooms will not prevent viral contamination and can actually lead to higher rates of contamination of cell cultures, which is catastrophic during large-scale production. An in-depth analysis shows that placing the equipment in a cleanroom can inhibit economic payback.

Instead, the industry should rely on closed processing for upstream processes. Independent of the environment, closed processes allow cell culture to occur in vessels that are not exposed to outside air and can be steam sterilized. Closed processing also avoids opening the system for sampling, something that could contaminate your cell culture.

To scale up, productivity must improve

Annual plant-based meat production in the US is estimated at 1.3% of the total meat production category. To scale to the point that cultured meat is commercially viable and available, companies need to significantly expand production, something that will require improvements in cell yield and reliance on much larger culture volumes (e.g., >50,000-liter bioreactors).

Yield refers to the ability to grow more cells in the same volume of culture media. Increasing cell density drives down the cost per pound. Currently, yield is a limiting factor, with only a fraction of the bioreactor being cell mass within cell culture processes. The rest is typically water and gases. Viability in the industry thus rests on developing solutions to greatly improve yield and productivity. The good news is that cell density was also an issue for cell culture in biopharma 25 years ago, but it has been largely solved. Back then, the target was to get one gram of drug substance per liter of media, a figure that has increased 40-fold in the intervening years.

Continuous processing may intensify yield

Drawing lessons from biopharma, we may achieve greater intensified growth through perfusion or running multiple harvests from a single batch. With perfusion, you regularly harvest a fraction of the cells and continuously add fresh media. This reduces the concentration of growth-limiting catabolites.

One limitation of continuous processing is that it’s difficult to scale up. Instead, the equipment is inherently lower volume and tends to be scaled out, using multiple smaller units. It can take many perfusion bioreactors to achieve the same amount of final product, thus increasing the size of a facility, which just shifts—not reduces—capital costs.

Product differentiation—consumers want a range of cultured meat products

Ground beef and sausage have been the obvious proof-of-concept commodity meats. Now, producers are aiming for a range of niche products, such as heritage pork, turkey, and even an A5 Kobe steak. Producing high-value meats will make it easier to achieve cost parity.

The technology for that assembly process is under development, and there’s lots of excitement about possible products. Startups are experimenting with growing fat, tissue, and blood cells, then putting them together in an optimized mix. While it may take a few years, some companies are experimenting with producing 3D meat. Also, cellular differentiation to produce fat, connective tissue, and muscle will eventually bring us a cultivated cut of meat that looks like a steak.

Sign up to receive CRB’s 2023 Horizons: Alternative Proteins report

Built on the inputs of more than 150 industry leaders, we explore the factors affecting the efficient and profitable scale-up of the alternative proteins market. Our report covers everything from processing and operations to sustainability and regulations.

Scale up requires flexibility

Facility and equipment flexibility makes room for improvements in both processes and product lines as they grow. It can be built into the process during the design of a facility, the equipment used, and the utilities. Flexibility is crucial whether you intend to scale up to the size of a biotech blockbuster facility or scale out to include portable equipment and processes.

Operations improvement studies allow us to evaluate potential process and facility flexibility. These include:

- Sensitivity analysis – What would happen if productivity improvements were realized? What changes if one raw material were substituted for another?

- Computational fluid dynamics (CFD) modeling – This allows an assessment of such things as the effects of mixing within a tank to ensure high cell density stays suspended and raw materials are well mixed.

- Cost modeling with production at different scales and utility consumption modeled at those scales.

It may be possible to improve efficiency and cost-effectiveness by designing a space to accommodate smaller bioreactors and more auxiliary equipment. Multiple-harvest perfusion (i.e., continuous processing) diminishes the need for larger bioreactors. Ideally, this is designed at the pilot plant level to assess proof of concept.

Downstream flexibility in the meat processing plant

Once cultured cells have been cut off from their oxygen and nutrient supply, they die. This is the transition step between cell culture and the downstream processing that turns them into food. Currently, this is the point that regulatory oversight in the US shifts from the FDA to the USDA.

One way a company can scale quickly without taking on unnecessary risk is to design the core process (i.e., cell growth) using permanent equipment, with flexible auxiliary and downstream processing. The bioreactor would be large, stainless steel, and designed to be flexible to incorporate future processes, such as perfusion. Meat processing and packaging would then rely on skidded equipment, or equipment on casters or wheels, that could be easily reconfigured in a well-designed and adaptable facility. It could also include spare processing space to accommodate changing needs.

Companies must be able to adjust quickly to consumer demands. Even in an established market, consumer trends and preferences can be cyclical and impacted by world events. This market segment hasn’t been fully proven out, and we don’t know what final formats consumers will prefer. This makes flexibility in downstream processing so important. For example, ground beef could be packaged as patties, meatballs, or in a chub. One day it may also be formed into a whole cut of meat.

Outsourcing the processing of final product

An alternative scenario is to outsource processing and packaging of the final meat product. This has the benefit of minimizing capital investment in a processing facility. It also makes it easier and faster to pivot to another contract processor if consumer trends change (e.g., frozen, fried chicken cutlets become preferred over refrigerated patties). Finally, it allows manufacturers to focus on their core areas of expertise, reducing the number of in-house staff and accelerating market launches.

The drawbacks include the added cost of refrigerated transportation and warehousing, the increased supply chain risk that comes from a potential lack of available contract processing plant space, and no in-house quality control.

A sustainable path to the future of cultured meat

Innovative science continues to develop faster and more cost-efficient ways to reach cultured meat 2.0. CRB has the expertise and experience to design and deliver a scalable cell-based meat manufacturing facility that is cost effective, flexible, and sustainable.

For more insight on the future of cultivated meat, download Horizons: Alternative Proteins or contact us to talk about your scale-up challenges.