The science of manufacturing cultivated meat has progressed significantly in the last few years, but manufacturers still face hurdles to get their products to market. This is a look at that evolving science and the future of cultivated meat.

The main challenge of making cultivated meat a commercial reality lies in producing enough cultivated meat at a reasonable price point. The cost of producing one hamburger has gone from $278,000 in 2013 down to about $4 ; while that is a much more reasonable price, scaling-up is still a major challenge in the industry.

So is regulation. Is it food? Is it biotechnology? Who is responsible for a meat product that doesn’t come straight from the animal?

But all these challenges are irrelevant to producers if consumers won’t even buy into this futuristic food. Here’s how this growing industry is shaping up and what it means for producers, consumers and the rest of the food industry.

Consumers have latched on to the promise of cultivated meat

Cultivated meat, also called cultured meat or cell-based meat, is produced from growing animal cells in-vitro rather than as part of a living animal. The process involves harvesting cells from an animal, multiplying those cells through proliferation, and making them into the muscle, fat and connective tissue through profusion to create meat. Since the first cultivated hamburger was unveiled in 2013, the science has expanded to growing chicken, duck, steak, pork and fish from cells. And there are more products in the works.

This technology has the potential to address several of the major ethical, environmental and public health concerns associated with conventional meat production. But it does no good if there isn’t a market for cultivated meats.

The Department of Psychology, University of Bath, Bath, UK, and the University Studies, Portland State University, Portland, Ore., about U.S. adults’ attitudes toward “cultured” or cultivated meats.

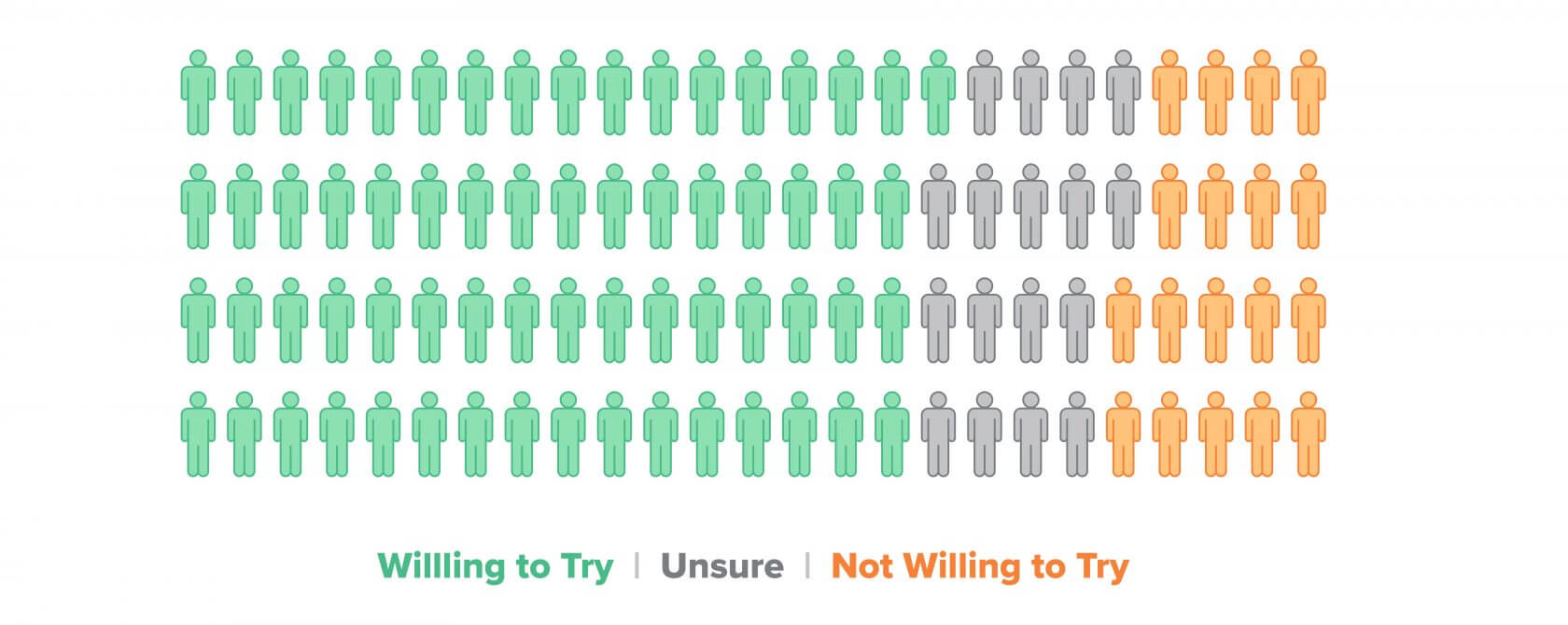

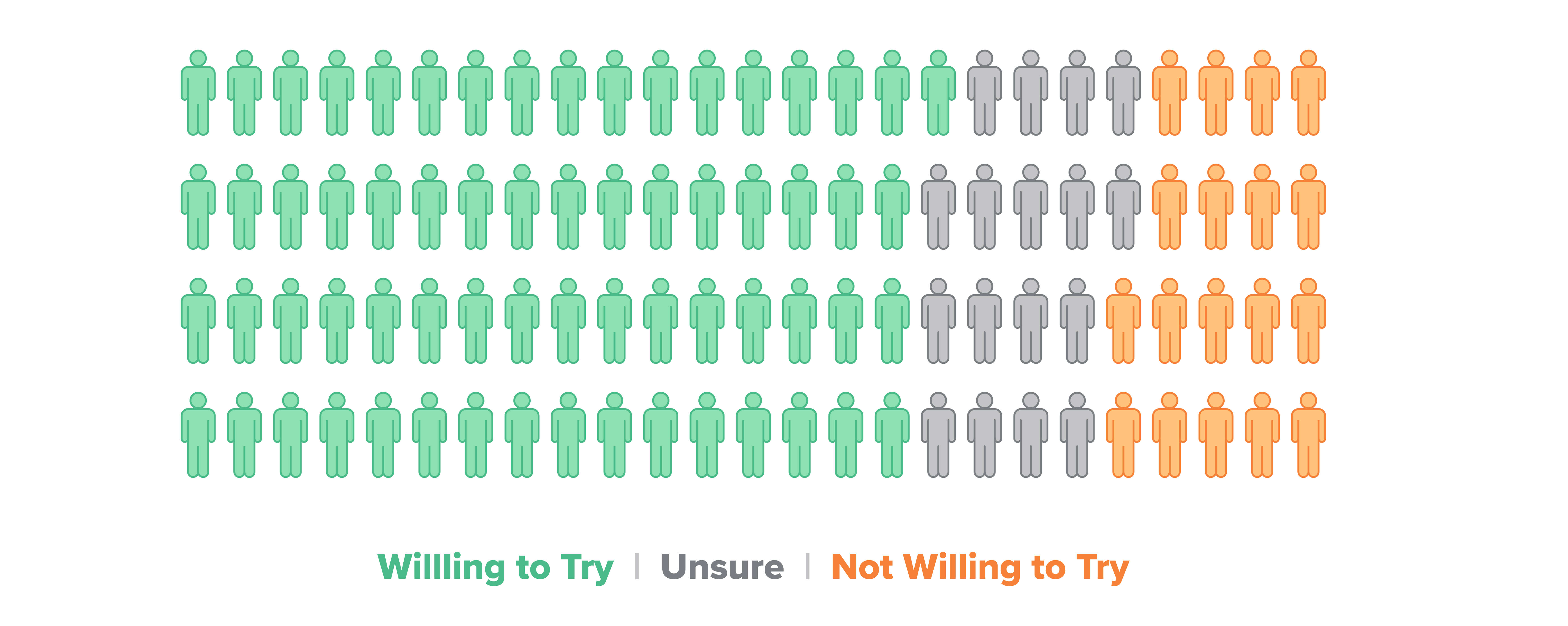

The study revealed that 64.6% of participants were probably or definitely willing to try cultivated meat, and only 18.4% were probably or definitely not willing to try cultured meat; 16.9% were unsure. Furthermore, the study positioned cultured meat with three different frames—“societal benefits,” “high tech” and “same meat”—meaning it tastes like conventional meat. Participants were much less likely to try cultivated meat when it was presented as “high-tech.”

The implications of this study are important to the industry. Consumers are willing to try and buy meat grown from animal cells, but it must be marketed the right way. Societal benefits and a similar taste profile were more compelling reasons for participants.

This demonstrates an opportunity to carve into the growing meat substitute market which is projected to reach $13.8 Billion by 2027. . Consumers choosing plant-based diets and meat alternatives for environmental and ethical reasons may be swayed by cultivated meat.

“According to industry experts, classic vegan and vegetarian meat replacements, as well as insect-based meat alternatives, are less likely to grow beyond the current vegan and vegetarian trend, as they lack the sensory profile to convince average consumers,” another study says.

Cultivated meat could tout similar benefits to plant-based meat when it comes to sustainability and environmental impact, while also not harming animals. But it has the added bonus of the same flavor and texture as conventional meat.

Challenges ahead for cultivated meat producers

So the technology is rapidly evolving and a market for cultivated meat is developing—what stands in the way of commercial success? It all revolves around the production process. Companies have to find a way to scale production to make the cost of the products feasible for consumers. They also have to navigate an uncertain regulatory environment. And they need manufacturing facilities suited to address both of these concerns.

Scaling up production

Growing a full-fledged meat product from animal cells is a complex process, and . The variation starts upstream, with differences in media types, cell types, and even whether to use native cells or genetically modified cells. And it continues downstream, to what the final product will look like. Some companies may opt for a whole muscle cut, while others target a ground meat product, or formed meat product. But the science boils down to a basic process where cells are harvested, multiplied through proliferation and made into the muscle, fat and connective tissue through profusion to create the meat.

At lab scale, this is a costly and time-consuming process. But according to an analysis from the Good Food Institute’s Senior Scientist Dr. Liz Specht, cell-based meat produced at industrial scale will likely rival conventional meat costs. To get to commercial scale at a competitive price point, manufacturers need to look at these five component technologies.

Cell lines

The type of starter cells matters for process scale and cost because some can grow more rapidly or have more flexibility in the type of cell they can become. Additionally, some are more stable for longer. Investing in a certain type of cell upfront has cost implications down the line.

Cell culture medium

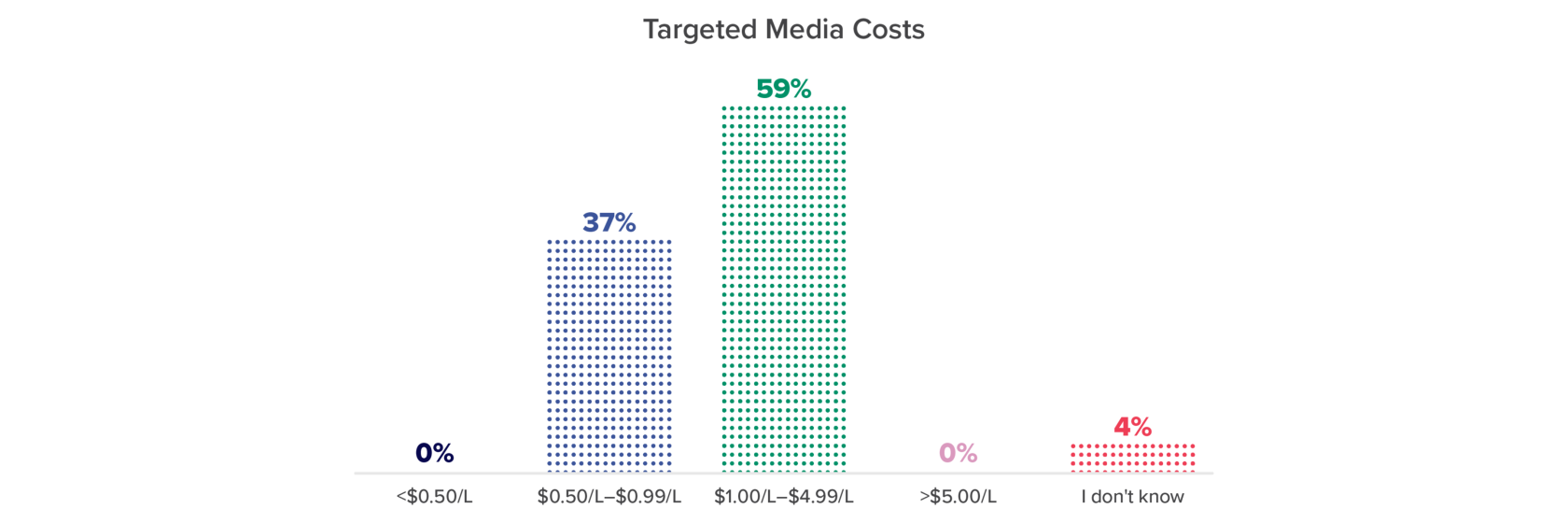

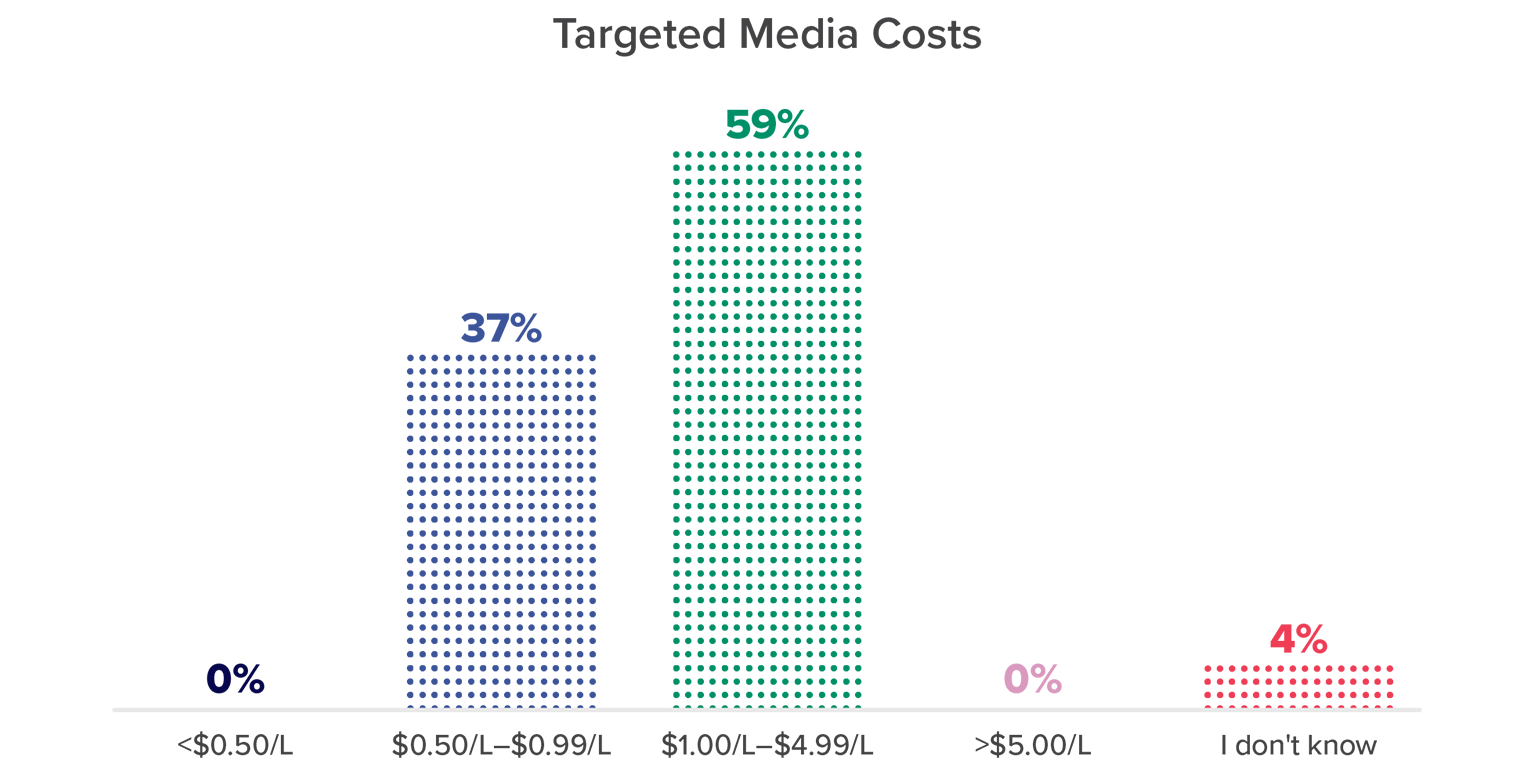

The medium provides the fuel cells need to grow. This is also one of the most significant contributors to cultivated meat’s high cost. If manufacturers can find options—like a medium free of animal-derived components—production and the final product will be much cheaper. Our 2023 Horizons: Alternative Proteins data indicates that most manufacturers are targeting media at $2/L or less.

Scaffolding and downstream processes

Scaffolding and downstream processing structure the cells into the final product, be it minced meat or a chicken breast. A cut of meat has a much more complex structure, requiring these additional considerations, whereas ground meat doesn’t, making it cheaper to produce. Our Horizons data indicates that roughly a quarter of producers plan to use scaffolding, while others plan to use forming, extrusion or 3D printing.

Bioreactors

Manufacturers can look to the biopharma industry for guidance—there are animal cell cultures growing in large-scale bioreactors there already. There are two basic types of bioreactors that will be most common in cultivated meat production. Stirred tank bioreactors are common in the biopharma industry for animal cell culture on a large scale. According to Dr. Specht, companies seeking to use tissue perfusion bioreactors to shape the cells into meat will need some engineering ingenuity to scale the perfusion step, as these bioreactors only exist at smaller scales. Our Horizons: Alternative Proteins survey revealed that new bioreactor additions will be measured and deliberate. Only 2% of the industry is planning on large-scale, industrial sized bioreactors by 2027, , and determine their customer base, before launching at full scale.

Supply chain and distribution

A supply chain for cell-based meat at large scales does not exist. Commercial viability depends on building this and distribution channels or adapting from existing chains.

Regulating cultivated meats

Companies are making steady progress on scaling up production, but industry regulation is still slow to develop. The main question is: who has jurisdiction? Regulatory approval in Europe, for example, may be simpler. Cultivated meats fall under the Novel Food Regulation.

Alternatively, in the United States, the snag is determining whether the USDA or FDA has oversight. The former regulates livestock and poultry; the latter is the authority on cell-culture technology. The two governing bodies agreed in 2018 to create a joint regulatory approach and in March 2019 established a joint agreement that outlines which agency has oversight of human food produced using animal cell culture technology. Companies have started to capitalize on this agreement. Some have already achieved regulatory approval in the U.S. and 75% of the remaining companies planning to have regulatory approval by 2025, according to Horizons.

Cultivated meat manufacturers in the U.S. have to plan their process and facility to both USDA and FDA standards. Often, this requires outside help from consultants who have expertise in both areas and can help producers determine which guidelines apply.

Creating a cultivated meat facility for the future

With myriad uncertainties facing this growing industry, anticipating facility needs down the road poses another challenge. Without a clear picture of the industrial-scale process or regulatory compliance, it’s increasingly difficult to create a facility that can accommodate a company in the future.

Again, it helps to look to the biotech industry here. Seek outside expertise to understand what works elsewhere and how it can be applied to cultivated meat production. For example, biotech provides a good template for design, but it must be right-sized for cultivated meat production. In particular, the high-end finishes that are typical of biopharma facilities may not be necessary in a food facility. That’s one more area where engineers must seek creative solutions to bring down the cost of producing cultivated meats.

Despite the challenges—or maybe because of them—this is an exciting and rapidly changing time for cultivated meat. Manufacturers who solve these problems of scale and cost, while skirting regulatory ambiguity, stand to corner a market that has great potential.

“While we think its potential benefits extend far beyond the business realm, cultivated products are positioned to offer major economic benefits over traditional meat,” says Kristopher Gasteratos, founder and president of the Cellular Agriculture Society, San Francisco. “I think these reasons in support of cell-ag processes are enticing to conventional animal-based industries that understand the long-term unsustainability of intensive animal-ag, as well as investors who foresee massive potential in cell-ag.”

Creating future-proof facilities that can handle unknown demand will be particularly important to the success of cell-based meat. Engineering ingenuity is critical.

Ready to carve into cultivated meats? Let’s talk.