Technical and economic due diligence saves $1.18 billion capital investment project

We help clients from every industry examine the economic and technical viability of their projects, from modest facility expansions to billion-dollar design and construction projects. But what does this due diligence process actually look like in action?

“Will it work?”

These three little words conceal enormous risk for businesses contemplating a capital development project, whether a greenfield manufacturing facility or a new process technology to enhance existing operations. Does it make sense to produce ATMP ingredients in-house with a custom-built facility? Will these refrigerated food production lines improve throughput? Will this specialty chemical manufacturing plant pay off?

Project Details

Client

Confidential Client

The client:

We recently worked with a leading company that manufactures an essential amino acid ingredient for animal feed. To make their product, they rely on synthetic technology that uses a high volume of hazardous chemicals.

The challenge:

Looking for a way to sharpen their competitive advantage, our client’s research led them to a new technology that would mean replacing their existing process with a modern continuous fermentation process, but that technology was so new that it hadn’t yet been proven on a commercial scale.

The big questions:

The company’s preliminary two-year study had determined that building a new plant at the same scale as their existing operation would cost $1 billion. Because the technology in question was relatively unknown, they would need an additional $18 million to build a pilot plant, which would allow them to study the new process and address any challenges before risking a much larger capital expenditure. So was that the right course of action?

How we helped:

Our technical and economic due diligence study helped our client answer the key questions:

- Would a new plant based on this fermentation process be viable?

- How long would it take to build the pilot and commercial-scale plant?

- Would the new plant be competitive in the marketplace?

- Would it be competitive with their existing process?

The result:

Based on our assessment, our client decided not to proceed with the project, saving them from investing more than a billion dollars.

Here’s why.

So many uncertainties lurk in the details, making it immensely difficult to predict ROI with a high degree of certainty. Unless you can plan your proposed facility down to its atomic pieces, resolving every unknown and disambiguating every process decision, that uncertainty will remain. And so will the possibility of an investment decision based on incomplete or inaccurate information. The results could be disastrous.

We help companies like yours avoid such disasters. We offer a thorough technical and economic due diligence assessment designed to answer three key questions with a high degree of certainty:

The result is a clear picture of the project’s economic and technical viability, providing the insight needed to make the best possible decision for the company’s future growth.

How we make due diligence happen

Through many years of experience, our consulting team has honed a template for conducting due diligence assessments. Like all templates, it’s only a starting place. We frequently adapt it to suit a broad range of projects, from investigating new venture-backed technologies to assessing the long-term viability of ambitious capital projects and everything in between.

THE BOTTOM LINE: We undertake an audit of existing background information, and we establish some baseline information about the project’s expected outcomes.

As was the case in this instance, many capital projects arrive on our desk with a considerable volume of background material attached, including market research, aggregated project data, and paper studies conducted before our involvement began.

There’s value in this background material, but there’s also the potential for incomplete or incorrect information which, left unchecked, can leach into the bones of a project, hampering its growth or leading it down a perilous path. That’s why our first step is a complete audit of existing materials, designed to separate useful and accurate information from everything else.

Case in Point: We started the due diligence study by reviewing the materials and conclusions established during the company’s initial studies. In particular, we looked into the timelines and cost their research had indicated to build the pilot plant and the new facility.

The discovery phase is also our opportunity to establish some foundational details about the project. What are the production targets? How well-known is the market? Traditional industries typically have an established formula of scale, while pioneering industries sometimes require more investigation before we can fully understand their potential.

Case in point: Because we were dealing with a relatively new technology, we conducted additional research of our own.

THE BOTTOM LINE: We develop a detailed process model to narrow the project’s margin of uncertainty by degrees, finally arriving at a clear and conclusive estimate of both capital and operating costs.

This phase is based on two core principles:

I. The more detailed the process simulation, the more questions we can answer.

We begin by working with clients to design a process simulation, or to review and optimize an existing simulation based on their business plan. This simulation becomes our virtual sandbox, allowing us to analyze capacity, test process alternatives, and study potential challenges, ultimately arriving at a dynamic master plan designed to enable the leanest, most efficient and economical plant design possible.

Case in point: For this project, we developed a full process simulation to sharpen that $1 billion estimate. How much would it really cost to produce that essential amino acid using the continuous fermentation process, based on what we know of the emerging technology? We ran case studies and process alternatives through the simulation, studying the results from many different angles and using those results to establish capital (Inside Battery Limits and Outside Battery Limits) and operating plant costs with a high degree of certainty.

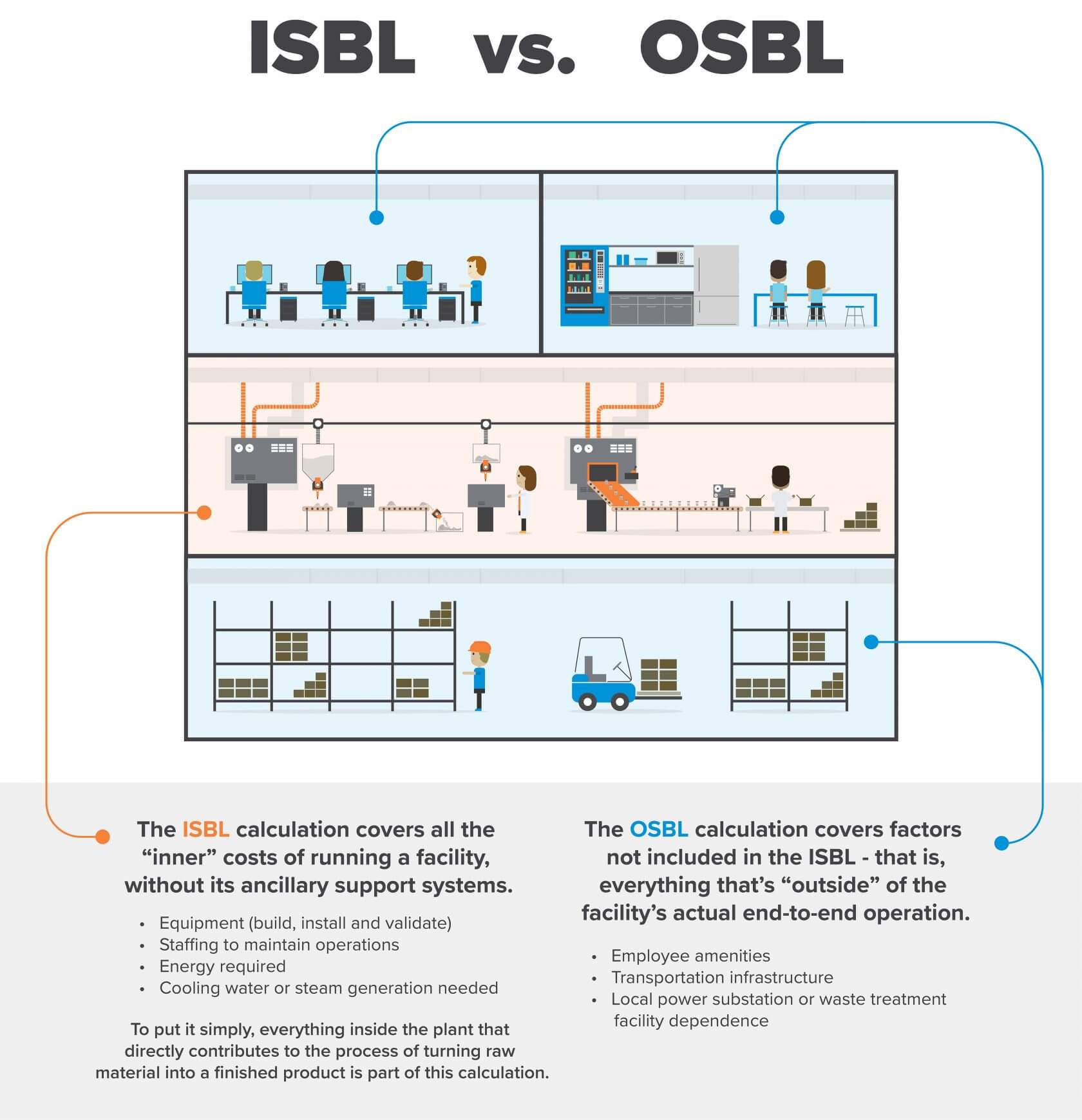

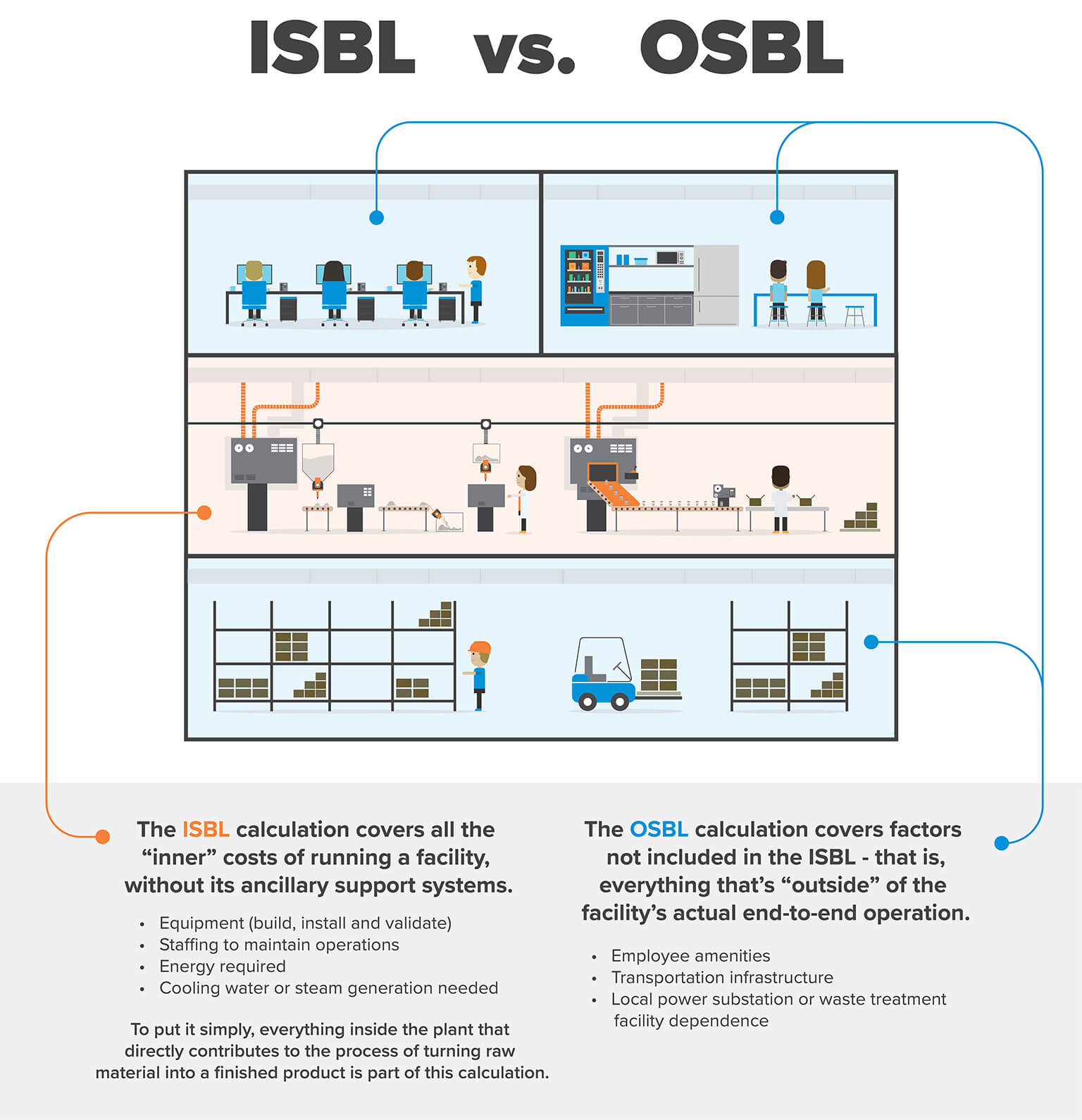

ISBL and OSBL are important factors in determining the true capital and operating costs of a plant, beyond the sticker price of individual pieces of equipment.

It’s standard practice to simply calculate OSBL costs based on a percentage of ISBL, but our due diligence team likes to go further than that. We base our calculation on the realities of each unique plant and its requirements, which helps us to reveal any misleading assumptions hiding inside a generic calculation. What belongs in the ISBL category at one plant, for example, may not belong there at another. A pharmaceutical manufacturer that produces its own APIs would include that production cost in their ISBL calculation, but a compounding pharmacy that purchases APIs from an overseas manufacturer is different; the cost to establish and manage that supply chain is part of their OSBL. The deeper we can drill into these details and understand the costs both inside and outside of the plant, the more reliable our estimate.

II. The more answers we have, the lower our cost uncertainty.

Determining the project’s capital and operating costs through an exhaustive assessment of the process and its attendant ISBL and OSBL factors is a bit like underwater diving: the answer to the most pressing questions lies on the floor of a deep sea, and to get there we need to descend through layers of detail, illuminating the depths of the project and revealing all that was unseeable from the surface. The deeper we explore, the closer we come to certainty.

We use a system of FEL (Front-End Loading) Levels to quantify this exploratory journey and help us understand what we do know, and what remains to be uncovered. It works like this:

- FEL Level 1: This is where many clients are when they come to us for a due diligence exercise. They may have done some initial studies, which we audit during our discovery phase, but the uncertainty of their capital cost estimate remains around +/- 50%.

- FEL Level 2: As we develop our detailed process simulation, we narrow our capital cost uncertainty to +/- 20%.

- FEL Level 3: At the conclusion of our technology and process deep-dive, we’re able to calculate your expended capital and operating costs within an uncertainty of just +/- 10%.

THE BOTTOM LINE: We work with clients to determine if and how their investment is likely to pay off, based on the insights revealed during our due diligence process. This will inform next steps.

Arriving at FEL Level 3 is the result of several intersecting achievements in our due diligence process, from designing the dynamic and granularly detailed model representing the whole manufacturing ecosystem to determining ISBL and OSBL plant costs with a high degree of certainty. Once there, we have the insight required to confidently answer the questions that initiated this whole exercise:

- Would a new plant based on this fermentation process be viable?

- How long would it take to build the pilot and commercial-scale plant?

- Would the new plant be competitive in the marketplace?

- Would it be competitive with their existing process?

What will it cost to make this work?

We understand the operating and capital costs in play with a high degree of certainty.

If it works, how long will it take?

From the details revealed in our process simulation, we know the scale of plant needed, the type of equipment and infrastructure required, etc. These are the details that converge to determine an accurate timeline.

Will this work?

We can confidently advise on the economic and technical viability of the proposed project.

Case in point: Our client’s business plan determined that they could build their pilot plant within a year. Our research told a different story: the new technology would not mature rapidly enough to support that timeline. The company was facing far greater delays than they expected between their initial expenditure and any possibility of a return on their investment.

Based on our conclusions, they chose not to proceed with their project. This likely saved them from considerable sunk costs and freed them to focus on maximizing their existing plant’s throughput.

Conclusion

“I didn’t know what I didn’t know.”

This is the common refrain from our clients after we work through the due diligence process together.

This is the greatest advantage of conducting an expert-led technical and economic due diligence exercise. It answers not just the obvious questions, but uncovers those you may not have known to ask, revealing mission-critical details that could dramatically impact your decision about if, when and how to invest in new projects.

Even in the case of this client, who had already conducted their own research, the due diligence study uncovered unknowns and fine-tuned their estimates.

Whatever our recommendation, you’ll have the information you need to move ahead confidently, sparing yourself from the risks of uncertain investment and freeing your capital for the projects that are likeliest to succeed in today’s marketplace.

Ready to begin the conversation about your own due diligence exercise?

Get in touch with Riju Saini.

Riju Saini, PhD

Process Specialist

About the expert

Riju, a Fellow of Simulation, Modeling, CFD, based in the Boston office, has extensive experience helping clients globally in the chemical, petrochemical, pharmaceutical, semi-conductor and allied industries. He drives CRB’s economic and technical due diligence services and works with clients worldwide to advance the state-of-the-art aspects of internal processes as well as those of simulation tools and process models.