Competitive benchmarking: the impact on the biopharma marketplace

Competitive benchmarking in the pharmaceutical industry can be particularly valuable where costs are high, margins are low, and processes are fairly standard. Finding a competitive edge may seem more difficult with these conditions but studying competitors can help your company gain a competitive edge and help with business decisions in the future.

In many ways, the pharmaceutical industry is a game of chess: you’re more likely to succeed if you can see several moves ahead, from both sides of the board.

This is the essence of competitive benchmarking. It’s about gathering the details that reveal who your competitors are, what they’re doing, and how their performance measures against the current landscape. The trouble is that these details are often scattered across press releases, patent applications, peer-reviewed journals, and elsewhere. Even once you’ve scoured the literature, you face the challenge of recognizing and integrating the facts that matter without getting bogged down by the ones that don’t.

Project Details

Client

Confidential Client

CRB’s economic and technical due diligence team has a lot of experience with this type of complex benchmarking exercise. We know where—and how—to look for insights about your competitors, and we can help you turn those insights into a proactive business strategy. Here’s the story of how we did that with one particular client.

The client:

This client produces a synthetic biopharmaceutical for use in animal feed. They’re an entrenched industry entity whose traditional operation relies on fossil fuels, despite a political and cultural climate that increasingly favors renewable energy sources.

The challenge:

In 2013, reports in the press revealed that a competitor had launched a joint venture with a company specializing in green technology. Together, these partners broke ground on a new plant in Asia, where they intended to produce the same biopharmaceutical using a more environmentally sustainable—and politically fashionable—approach.

This development prompted an urgent question for our client:

They tried to answer this question themselves but soon hit a roadblock. Their competitor’s process featured fermentation technology. For our client, who had spent decades manufacturing their biopharmaceutical synthetically, this limited their ability to understand if, how, and how soon their competitor’s pilot facility might pose a credible threat. They simply didn’t know the fermentation process and downstream purification well enough to translate their competitor’s press reports and patent applications into meaningful insights. That’s when they turned to us for help.

How we helped:

To undertake a competitive benchmarking exercise, you need a team with years of experience inside the type of operation you’re investigating. That’s how you bridge the knowledge gap between publicly available information and the reality of your competitor’s internal operations.

In this case, our in-house team included experts in both synthetic and fermentation-based processes. We also understand the costs and benefits of different approaches to energy usage, which helped us develop a picture of the competitor’s reality. By layering insights from press materials, patent applications, and our well-developed understanding of the technologies and systems in play, we had what we needed to determine how these two companies—our client and their competitor—squared off against each other.

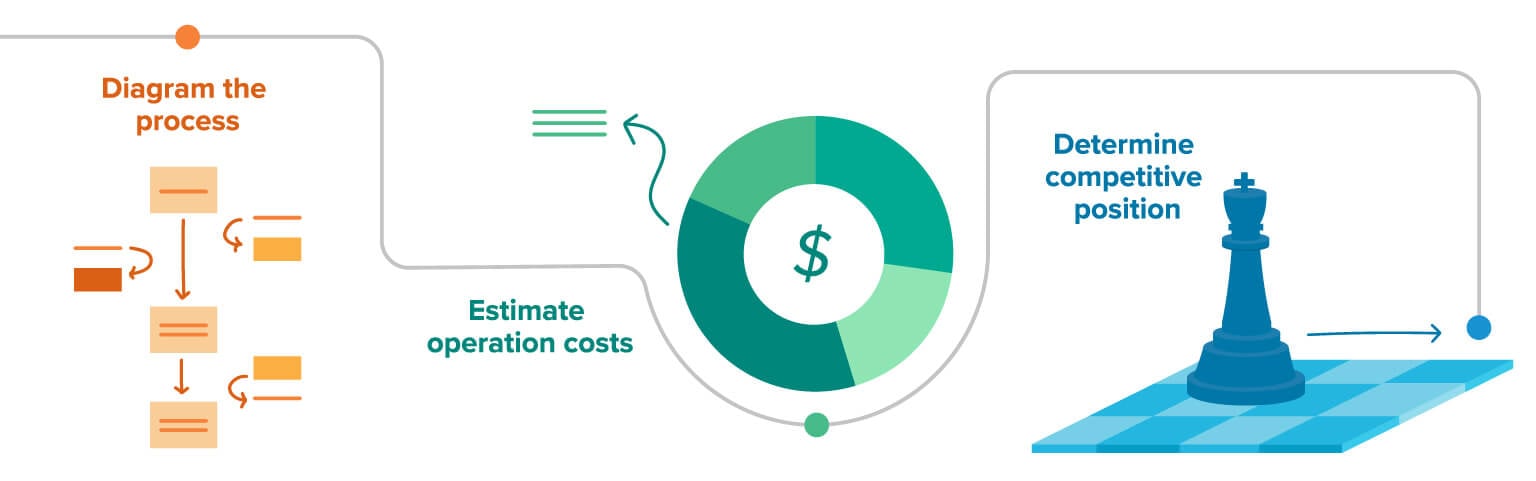

First, we diagramed their fermentation process from start to finish.

- Based on the competitor’s public claims about their target capacity and details from their patent applications, we developed a nuanced picture of their most likely process, including:

- How they move raw material into their new plant

- What happens in each process block as materials move downstream

- Their approach to purification

- The volume of byproducts (including waste) generated during this process, and how those byproducts are likely handled

That led us to a detailed estimate of their operational costs.

- Once we had studied their most likely process in detail, we estimated their Inside Battery Limits (ISBL)—that is, the end-to-end cost of turning raw material into a commercial biopharmaceutical using this competitor’s process. We arrived at this estimate by back-calculating their costs for such requirements as:

- Building, installing, and validating their equipment

- Acquiring raw materials and managing waste

- Supplying their facility with the necessary energy load via renewable sources

- Staffing their facility

From there, we determined their competitive position.

- Between this competitor’s selling point and our estimate of their operational costs, we had a good idea of their profit margin.

- This was the key to benchmarking their position within the competitive marketplace. A wide margin would suggest that this competitor had room to undercut our client; a narrow margin would indicate a more diminished threat.

The Result:

Our client had asked us how worried they should be. Our answer was twofold.

In the short term, the potential threat was minimal. This competitor hadn’t yet mastered their new technology, and their plant was relatively small; as a result, their cost of operating was initially very high while their potential distribution remained limited to the local Asian market. For our client, who was part of a well-established global supply chain, this meant there was little likelihood of disruption in the near future.

In the long term, however, we saw a potential threat. As their competitor’s technology matured, they would learn to operate their facility more efficiently, which would widen their margins and free more capital for expansion. Meanwhile, their approach to sustainability could win support from a growing wave of environmentally focused industry regulations, incentivizing their growth.

Sure enough, six years after our initial benchmarking exercise, our client brought us news that the same competitor had announced plans to increase their capacity. We conducted a new assessment, which confirmed that the competitor’s technology and process had evolved significantly in all the ways predicted in our initial report.

To remain competitive in the coming years, our client would need to recognize this shift in marketplace dynamics, and prepare for it. Here, too, our team was able to help.

How competitive benchmarking lays the groundwork for the next steps

When we started this article, I told you that the main objective of a competitive analysis is to answer the question, “How worried should we be?”. It’s true that this is often the question which triggers the benchmarking exercise, and which is answered by the bottom-line numbers we put together.

A good benchmarking exercise goes beyond that point, though, and answers another equally important question:

In the example I’ve outlined here, our economic and technical due diligence team continued working alongside our client following the benchmarking exercise. Over many discussions, we helped them to understand the future of their industry and to develop a strategic plan for investing in new and environmentally sustainable technology platforms—a plan that would help them not only recognize the shift underway in their competitor’s plant, but turn it to their own advantage, ensuring that their position in the marketplace remains firm.

This level of strategic consultation is key to converting competitive insight into decisive action. In other words, predicting your competitor’s next move on the chess board is only half of the game; formulating your own long-term strategy is the other.

Riju Saini, PhD

Process Specialist

About the expert

Riju, a Fellow of Simulation, Modeling, CFD, based in the Boston office, has extensive experience helping clients globally in the chemical, petrochemical, pharmaceutical, semi-conductor and allied industries. He drives CRB’s economic and technical due diligence services and works with clients worldwide to advance the state-of-the-art aspects of internal processes as well as those of simulation tools and process models.

Get in touch with Riju.