Manufacturers can scale up. Suspension-capable cell lines reproduce in the growth medium without the need for anchor points. This frees manufacturers from having to accommodate adequate surface area. Using commercially available single-use bioreactors, manufacturers can plan a linear scale-up approach from 25 to 500 L—some viral vector manufacturers with suspension-capable cell lines are even planning for 2,000 L units.

This scale-up pathway may not be entirely free of challenges. Some suspension-capable cell types tend to clump at high densities, for example. Solving these challenges will require further process development.

Suspension-capable cell cultures open the door to well-understood technologies. To produce viral vectors using a suspension-capable culture, manufacturers follow many of the same steps that producers of monoclonal antibodies or therapeutic proteins have had in place for decades.

Instead of relying on complex engineering or individually optimized processes, this means you can leverage existing knowledge to establish a scalable platform approach that maximizes the benefits of closed and automated processing technologies. This is the key to a more efficient facility.

A transition from adherent to suspension-capable in the future requires forethought and planning. Many manufacturers plan to meet their speed-to-market milestones by launching with an adherent cell line culture while developing a suspension-capable alternative in parallel for a future launch.

This degree of complex engineering may take significant time. It’s also risky; by committing to an adherent cell line before knowing for certain if it can be adapted for suspension (or if its suspension-capable version will be productive enough to justify the time and cost invested to develop it), you’re putting your capital investment on the line. Spending upfront resources to understand the journey to suspension-capable cell lines before facility build-out could pay off in the end.

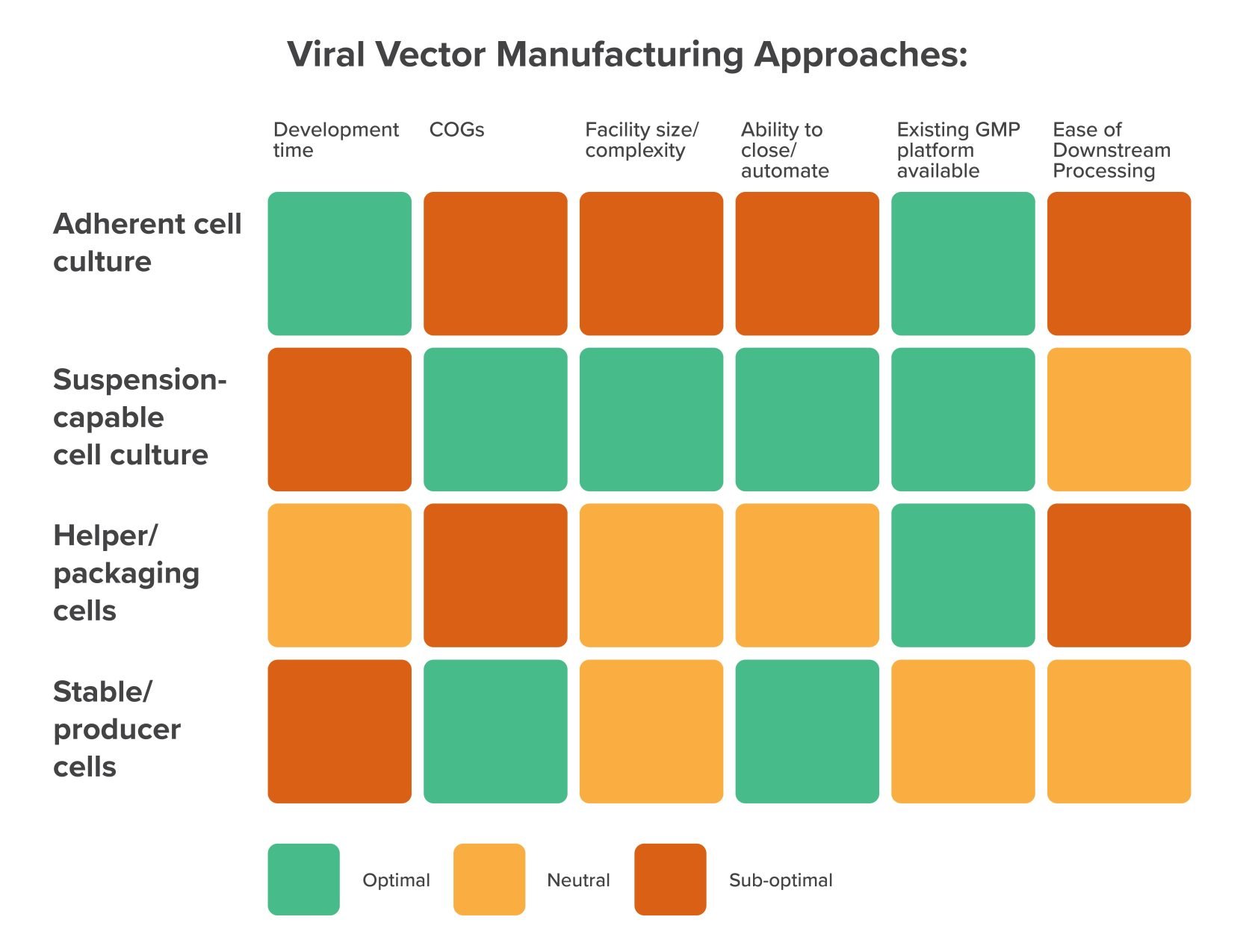

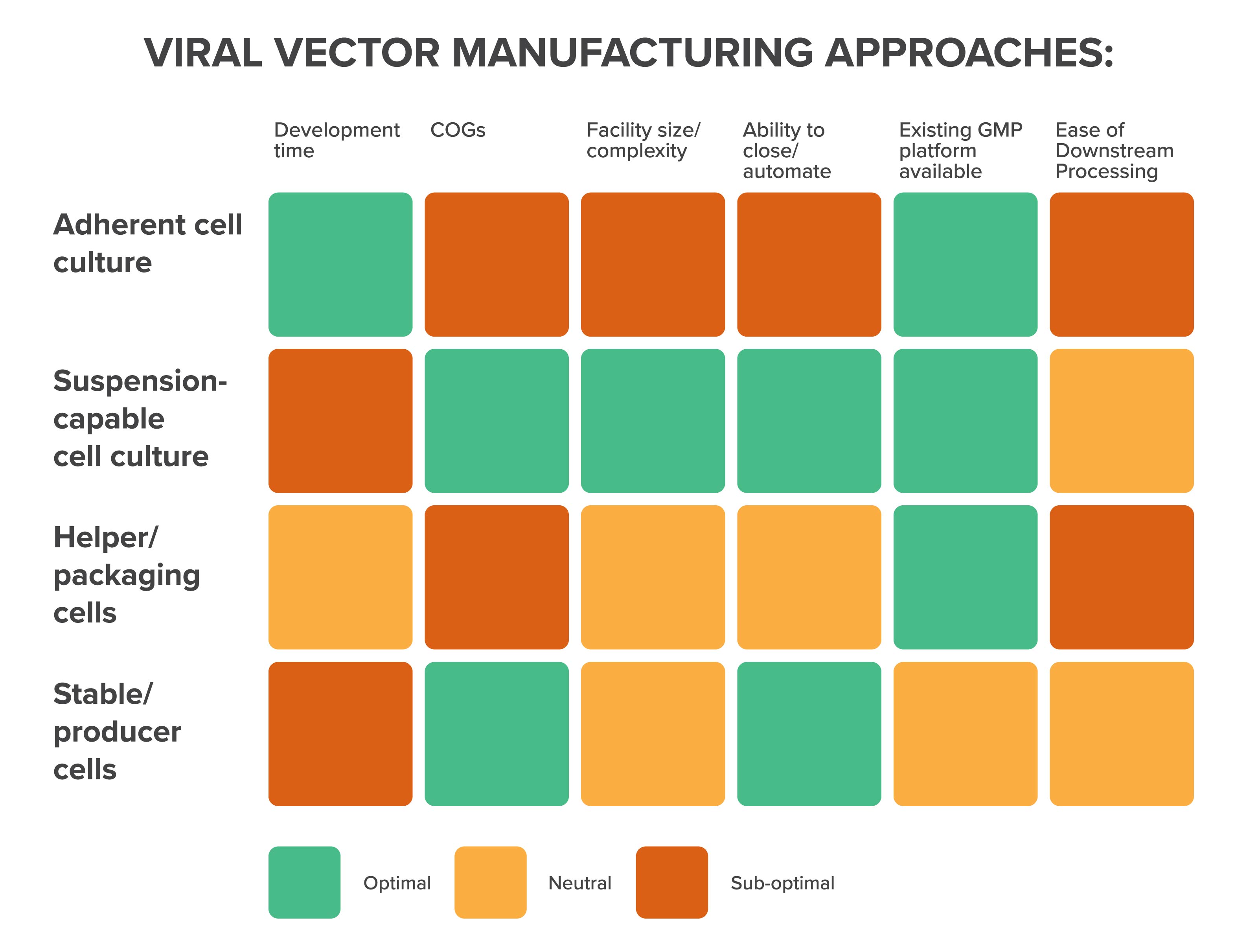

Your choice of vector production technique

Broadly speaking, there are two main platforms that the majority of viral vector manufacturers use, each with its own limitations and advantages: helper/packaging cells and stable/producer cells.

Their differences come down to how they propagate a specific vector, which has far-reaching implications in terms of the space and resources required within the manufacturing facility.

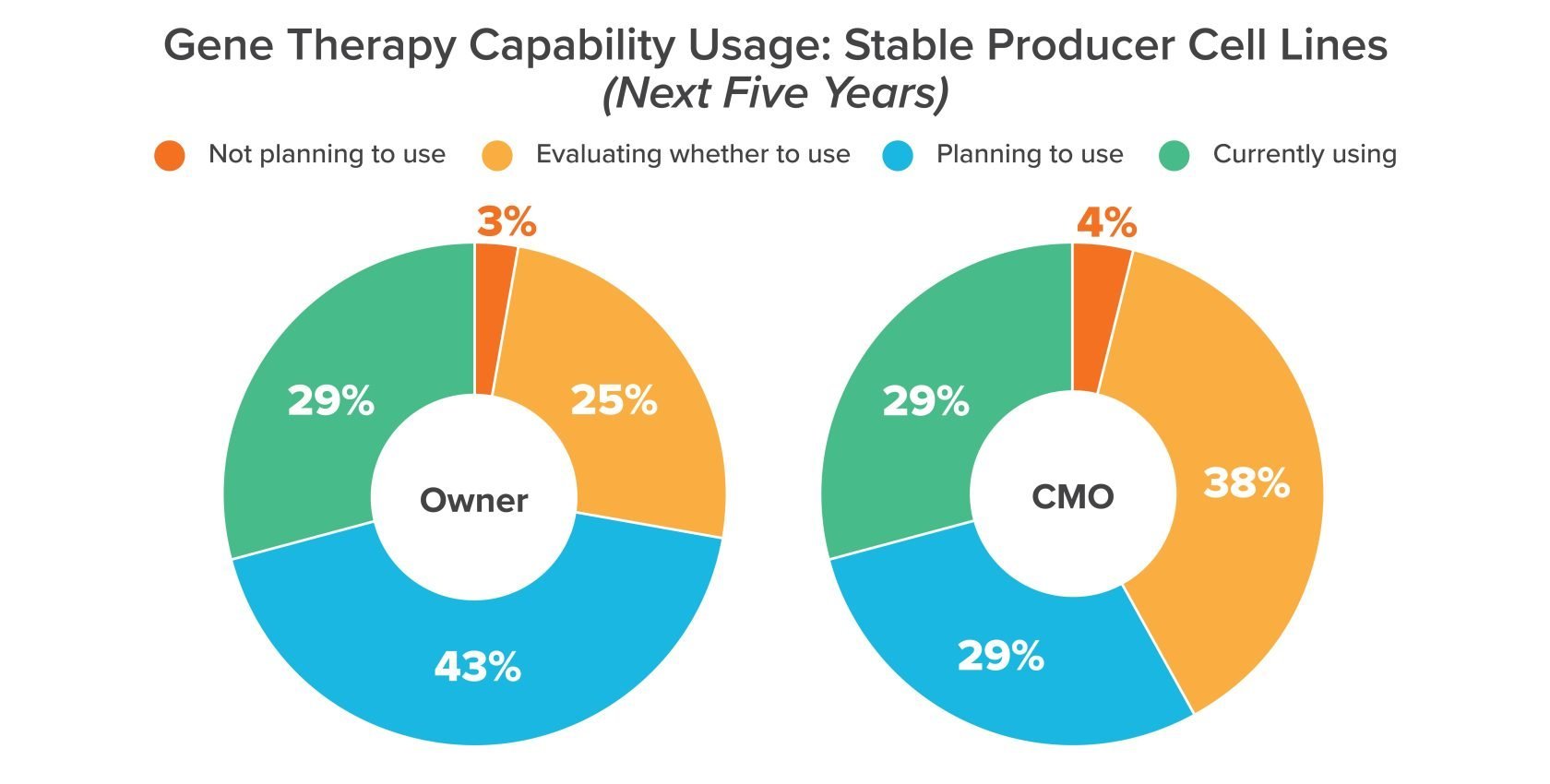

Helper cells are popular for lab-scale viral vector development, but as manufacturers look toward commercial-scale up, more of them are moving toward stable producer cell lines. That may come down to the fact that helper cell lines rely on large volumes of raw materials, which can drive up costs and expose manufacturers to supply-related delays.